Westside detached house supply this January remained essentially unchanged from December (616 to 617) but is up 11% compared to 554 last January 2017.

Westside detached home demand (sales) this January was up 26% from December (35 to 44) and up 19% compared to 37 sales last January 2017.

December & January are typically the quietest months for both supply & demand.

The result of this increase in supply and demand is a decrease in Months of Supply (MOS) to 14, from 17.6 last month and 15 last January 2017. (Usually a balanced market is in the range between 4-5 & 6-7 MOS with prices rising below 4 MOS and falling above 7 MOS). At 14 MOS, prices should continue to drop but because we are coming from 17.7 MOS last month and the market is getting busier towards Chinese New Year and the spring, we are seeing a lift in both the median (10.6%) and average (12.7%) price from $3.3M to $3.65M and from $3.591M to $4.049M respectively. Both are still down 3.9% median & 10.7% avg. from the October 2017 high. If demand stays low, MOS will continue to be high and it will be hard for prices to remain at these levels.

The highest sale price for a Westside detached home in January was $13.5M. The lowest price was $2.15M. Of those sales, 2 received the asking price or more and 42 sold below the asking price.

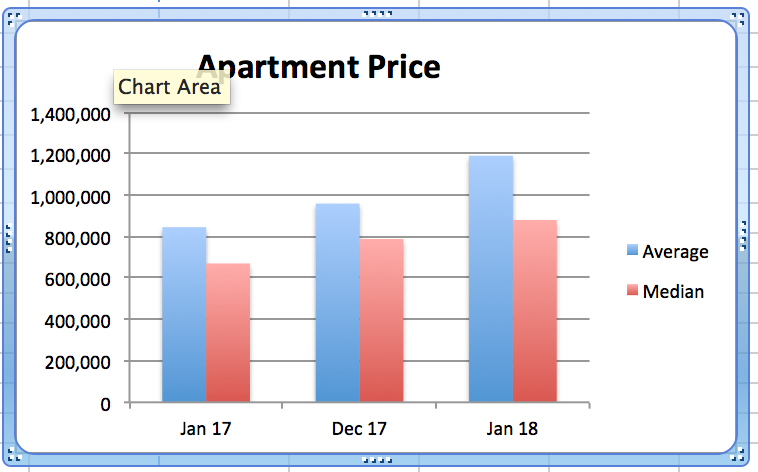

Westside apartment supply increased 6% to 568 units in Jan from 535 in Dec. but this is down 16% from the 677 listings we had last January 2017.

Demand dropped 3% to 243 sales in January from 251 in Dec. but this is up 15% from 211 sales last January 2016.

MOS is now up to 2.3 vs 2.1 in Dec but that is down from 3.2 last January 2017. These levels are low and create significant upward pressure on the prices as shown by the 25% jump in average prices from $959K to $1199K while Median prices are up 12% from $788K to $880K. Apartment prices have been quite flat since April 2017 in the face of very low MOS so we might say this price increase was overdue.

Westside townhouse supply increased 9.5% this January to 139 homes from 127 in December and up 29% from 108 in Jan. 2017.

Demand in January is down 8% to 24 units from 26 in Dec and this is equal to the 24 sales last January 2017.

Supply up and demand down increases the current MOS to 5.8, up 18% from 4.9 in Dec and up 29% from 4.5 last Jan 2017. Notwithstanding the increase in MOS, average prices jumped 8% to $1.792M from $1.663M in Dec. and up 45% from $1.233M last Jan 2017. Median prices dropped 5.6% to $1.519M in January from $1.61M in Dec but increased 23% from $1.232M last Jan 2017.

Detached home price reductions are still creating good buying opportunities. Apartment prices have increased in the face of low supply.

Townhouse prices are up and supply is rising while demand is off just a little.

Government regulations both here and in China continue to make it difficult for foreign buyers to bring money here to purchase real estate and that will create opportunities for local buyers. Interest rates, currency exchange, lending restrictions and conflicting negative press continues to dampen sales.

We are in a buyers market for detached homes with prices off the highs by 15 - 20%

Click on the link at the top right for Westside Graphs.

Please call me at any time for a considered response to any and all of your real estate questions.

Happy Valentine's Day!

Stuart