The supply of Westside detached homes in November is down 5% from October (740 from 776) and unchanged compared to November 2017. Westside detached home sales (demand) this November were down 5% from October (60 from 63) and down 26% compared to 81 sales in November 2017. November sales are down 47% from the 10 year November average of 113 sales.

Months of Supply (MOS) remains unchanged from last month at 12.3 which is up 35% from 9.1 in November 2017. (Usually a balanced market is in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS). With MOS unchanged, the average detached home price has also remained unchanged at $3.627M. The median price however was down 16% to $2.925M from $3.5M last month. This is a drop of 19% on average & 24% on median from the peak in 2017. If demand stays low, MOS will stay high and we should see continued downward pressure on prices.

The highest sale price for a Westside detached home in November was $19.2M. The lowest price was $1.47M. Of those sales, 7 received the asking price or more and 53 sold below the asking price. The implication of this is that with a sufficiently attractive (low) asking price we can still generate multiple offers.

Westside apartment supply decreased 4% to 1359 units from 1412 units in October but this is up 94% from the 699 listings we had in November 2017. At the same time Demand decreased 23% to 207 sales in November from 268 sales in October and this is down 45% from 380 sales in November 2017.

MOS in November is up 25% to 6.6 from 5.3 September and up 257% from 1.8 last November 2017. The average price increased 2% to $1021K from $1006K in October and was up 3% from November 2017. The median price increased 4% to $780K from $749K in October and is unchanged from last November. Both average and median prices are down by 15% & 11% from the peak of $1.199M and $880K in January 2018.

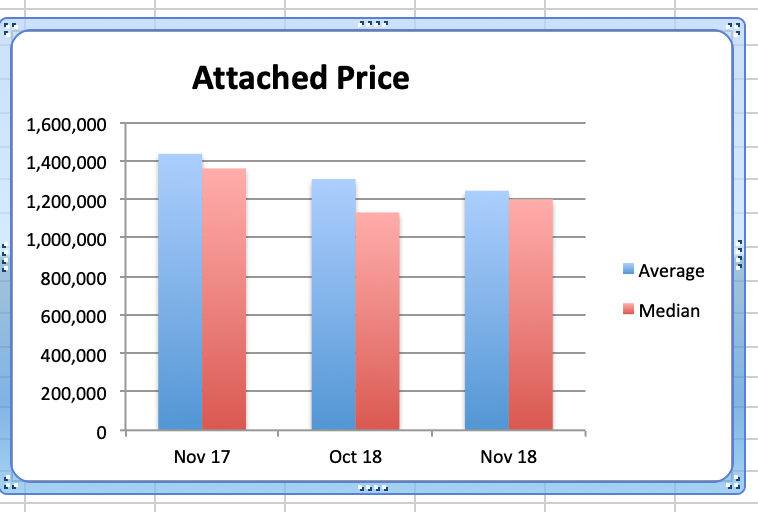

Westside townhouse supply decreased 7% this November to 240 homes from 250 in October but that's up 48% from 162 in November 2017. Demand in November is down 37% to 29 sales from 46 in October and down 31% from 42 sales last November 2017. With supply and demand both down the current MOS increased to 8.3 from 5.6 in October and from 3.9 in November 2017. Average prices fell 5% to $1.244K from $1.305M in October and were down 13% from $1.436M last November 2017. Median prices increased 6% to $1.2M from $1.131M in October and are down 12% from $1.36M in November 2017. As with apartments, townhouse prices are down (31% average and 21% median) from the peak prices last January.

Detached, Attached and Apartments on the west side are still experiencing price reductions and while this is creating good buying opportunities, some buyers continue holding off in anticipation of further declines. This should exacerbate the decline and soften prices further.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region dropped 42.5% to 1,608 this November from 2,795 sales in November 2017. This is down 18.2% compared to 1,966 sales last month in October 2018. Last month's sales were 34.7% below the 10-year November sales average and is the lowest since 2008.

The total number of properties currently offered on the MLS® system in Metro Vancouver is up 40.7% from November 2017 to 12,307.

For all property types, the sales-to-active listings ratio for October 2018 is 13.1%. By property type, the ratio is 8.9% for detached homes, 14.7% for town homes, and 17.6% for apartments.

Downward pressure on home prices occurs when the ratio dips below the 12 per cent mark for a sustained period, while upward pressure occurs when it surpasses 20 per cent over several months.

With market prices declining across the region, there may be opportunities for some buyers compared to the all time high prices experienced last year but financing is difficult and interest rates continue to climb.

All governments should encourage development of rental properties through zoning & tax incentives and stay away from rent controls that discourage rental property development.

We have a voting coming up in regard to how the BC government is chosen. Please remember to vote before December 7th.

First Past the Post (our current system) vs Proportional Representation (PR).

My take on it is that there is so little detail of what they government is proposing that if this Proportional Representation goes ahead it is basically a blank cheque giving the existing government the power to inflict whatever type of government they want on the public in perpetuity. If we should even be considering electoral reform, it should be based on a clear concept, not three options which would trade our existing political system for one to be determined in the future by legislative committee and cabinet. Wholesale change like PR risks dumping the baby out with the bathwater. Our system could be improved but maybe a better option is to revise and refine it rather than starting over in uncharted waters.

I voted to retain the current First Past the Post system. I think it is a mistake to change just for change's sake and particularly to change to advantage a number of smaller special interest groups. We deserve a much harder look into the benefits of revising our existing system vs replacing it with something totally new.

Please call me at any time for a considered response to any and all of your real estate questions.

Best regards,

Stuart