The supply of Westside detached homes in January was 528, down 5% from 555 in December and down 19% compared to 652 in January 2019.

Westside detached home sales this January decreased 41% from December (34 vs 58) but were unchanged from January 2019. Detached home sales are down 58% from the 10 year January average of 81 sales.

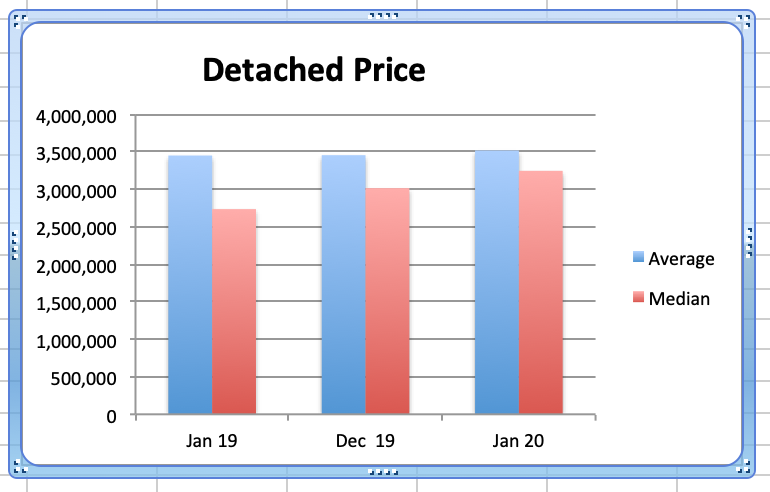

Months of Supply, (MOS) was up 62% from last month to 15.5 from 9.6 and down 19% from 19.2 in January 2019. (A balanced market used to be in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS but in the last couple of years that seems to have shifted and now appears to be 8 to 10 MOS). The Jan average price increased 2% to $3.517M and the median detached home prices increased 8% to $3.245M. Current prices are down 22% on average & 16% on median from the peaks in Oct 2017 and Jul 2017.

The highest sale price for a Westside detached home in January was $8.88M. It was on the market for 406 days before it sold. The lowest price was $2.138M. It sold immediately. Of the 34 January sales, 5 received the asking price or more and 29 sold below the asking price.

Westside apartment supply increased 5% in January (950 vs 909) but this is down 20% from the 1193 listings we had in January 2019. At the same time, demand decreased 19% 211 sales v. 260 sales in December but this is up 59% from 133 sales in January 2019.

MOS in January decreased to 4.5 from 3.5 in December and is down 50% from 9 MOS last January 2019.

The average price decreased 1% to $907K in January v. $918K in December and was down .6% from January 2019. The median price increased slightly to $755K v $749K in December and is unchanged from last January. Average and median prices are down by 24% & 14% from the peak of $1.199M and $880K in January 2018.

Westside townhouse supply increased slightly this January (216 vs 214) from December and that's up 1.4% from 213 in January 2019. Demand in January is down 19% to 30 sales from 37 in December but that is up 50% from 20 sales last January 2019.

With supply relatively unchanged and demand down, current MOS decreased to 7.2 from 5.8 in December. That is down 32% from 10.7 in January 2019.

Townhouse average prices in January were up 17% to $1.6M from $1.37M in Dec. and were up 6% from $1.5M last January 2019. Median prices increased 20% to $1.517M from $1.26M in December are up 17% from $1.30M in January 2019. Average prices are down by 11% from the peak of $1.8M in January 2018. Median prices are almost at the peak of $1.519M in January 2018.

Average & median prices on the west side are still below the peak and that is creating good buying opportunities. Detached home prices, creeping up since Feb. 2019, are still off 22 & 16%. Apartments are still off 24 & 14% and Attached Homes are off 11 & 1.4%, so all appear still to be good value.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region increased 42.4% to 1571 this January from 1103 sales in January 2019. This is a 22.1% decrease from the 2016 homes sold in December. January 2020 sales were 7.3% below the 10-year January sales average.

The total number of properties currently offered on the MLS® system in Metro Vancouver is 8617, down 20.3% from 10,808 in January 2019. This is down 13.7% below the 10 year January average.

For all property types, the sales-to-active listings ratio for January 2020 is 18.2%.

Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.

So while regional numbers are below historical 10 year averages, westside properties are still further below the mark making them better relative value. Many sellers are still asking too much to generate offers while serious buyers are still finding financing and the stress teat a problem.

The new assessed values reflect the new pricing reality and help sellers gain insight into market value.

Please call me at any time for a considered response to any and all of your real estate questions.

Happy Valentines Day and keep that snow shovel handy!

Best regards,

Stuart