I hope this blog finds you and your family safe and healthy.

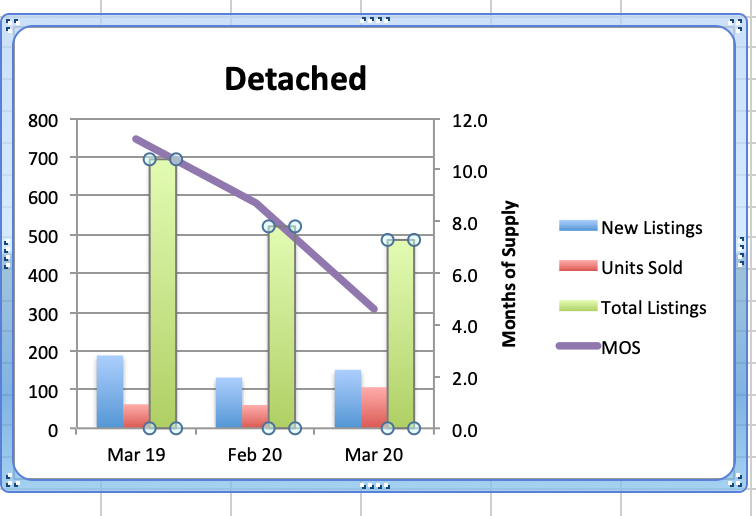

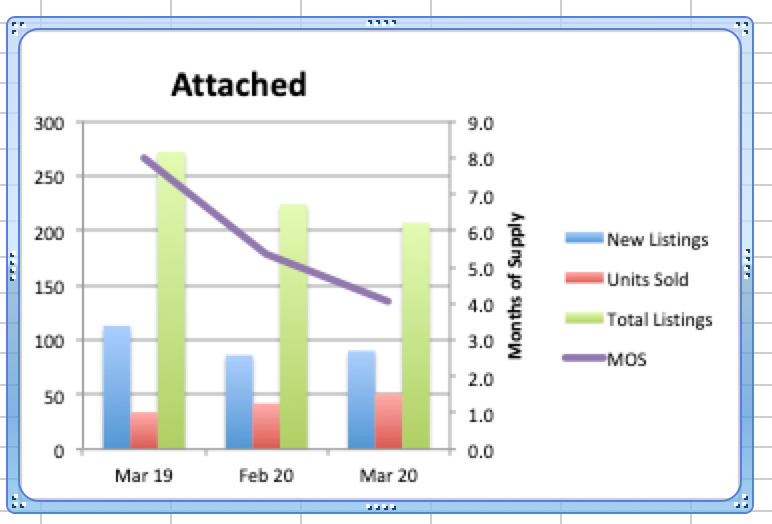

The supply of Westside detached homes in March was 486, down 7% from 521 in February and down 30% compared to 694 in March 2019.

Westside detached home sales this March increased 77% from February (106 vs 60) and were 71% higher than March 2019. Detached home sales are down 28% from the 10 year March average of 148 sales.

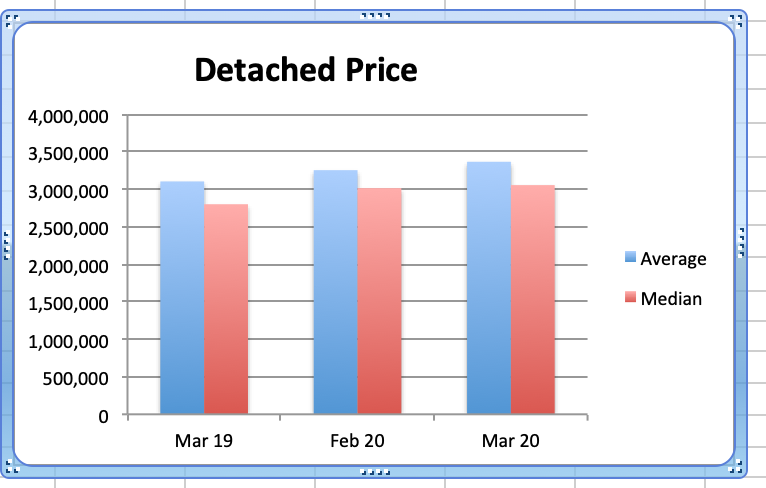

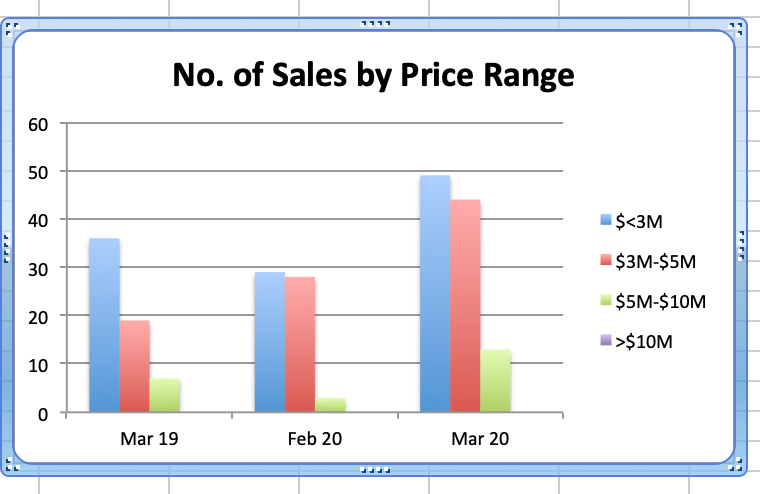

Months of Supply, (MOS) was down 47% from last month to 4.6 from 8.7 and down 59% from 11.2 in March 2019. (A balanced market used to be in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS but in the last couple of years that seems to have shifted and now appears to be 8 to 10 MOS). The Mar average price increased 3.4% to $3.366M and the median detached home prices increased slightly to $3.055M. Current prices are down 26% on average & 21% on median from the peaks in Oct 2017 and Jul 2017.

The highest sale price for a Westside detached home in March was $9.1M. It was on the market for 37 days before it sold. The lowest price was $1.558M. It was on the market for 458 days. Of the 106 March sales, 36 received the asking price or more and 70 sold below the asking price.

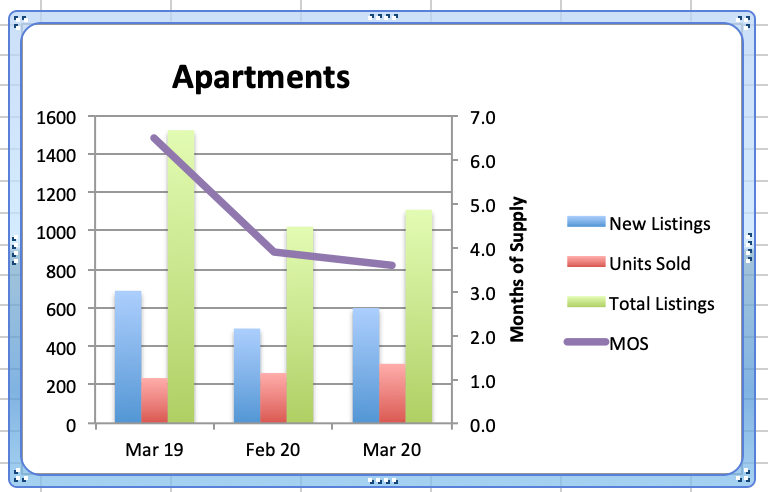

Westside apartment supply increased 9% in March (1109 vs 1021) but this is down 27% from the 1522 listings we had in March 2019. At the same time, demand increased 18% 309 sales v. 261 sales in February and this is up 31% from 235 sales in March 2019.

MOS in March decreased to 3.6 from 3.9 in February and is down 45% from 6.5 MOS last March 2019.

The average price increased 11% to $978K in March v. $882K in February and was up 10% from March 2019. The median price increased 4% to $790K v $760K in February and is up slightly from last March. Average and median prices are down by 18% & 10% from the peak of $1.199M and $880K in January 2018.

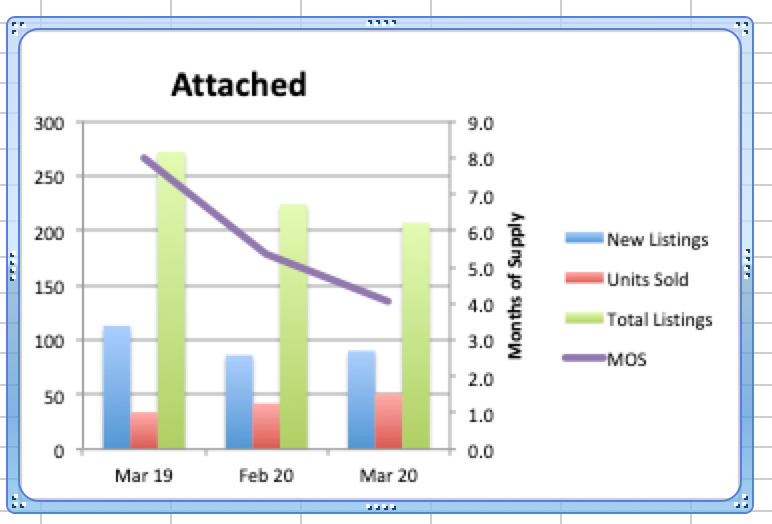

Westside townhouse supply decreased 8% this March (207 vs 224) from February and that's down 24% from 272 in March 2019. Demand in March is up 21% to 51 sales from 42 in February and that is up 50% from 34 sales last March 2019.

With supply relatively down and demand up, current MOS decreased to 4.1 from 5.3 in February. That is down 50% from 8 in March 2019.

Townhouse average prices in March were relatively unchanged at $1.31M from Feb and were down 5% from $1.38M last March 2019. Median prices increased 5% to $1.23M from $1.18M in February are up 6% from $1.16M in March 2019. Average prices are down by 27% from the peak of $1.8M in January 2018. Median prices are down 20% from the peak of $1.519M in January 2018.

Average & median prices on the west side are still below the peak and that is creating good buying opportunities. Detached home prices, creeping up since Feb. 2019, are still off 26 & 21%. Apartments are off 18 & 14% and Attached Homes are off 27 & 20%, so all still appear to be good value. The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region increased 46.1% to 2525 this March from 1727 sales in March 2019. This is a 17.4% increase from the 2150 homes sold in February. March 2020 sales were 19.9% below the 10-year March sales average.The total number of properties currently offered on the MLS® system in Metro Vancouver is 9606, down 24.8% from 12774 in March 2019. This is up 4.5% from last month.For all property types, the sales-to-active listings ratio for March 2020 is 26.3%.Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.Regional numbers are below historical 10 year averages, so westside properties, even further below the the 10 year averages are better relative value. Current supply is down dramatically and while demand is up for the early part of March the rapid onset of the Covid19 pandemic has changed our world and many buyers and sellers are on hold pending an indication of the extent and duration of economic damage wrought by the disease. March was caught in the middle of the realization of just how serious this pandemic is and it is difficult to see which way things will tilt in the next few months. Usually a drop in supply would force prices up but it is hard to see if the increase in demand we saw in early March will be sustained. The people who need to buy and sell will continue to do so while others may step back and wait for a sign. The recent rate drop may help that situation but it does not look like the banks are passing that benefit on to the borrowers.

Please call me at any time for a considered response to any and all of your real estate questions.

Everyone has told you how to stay safe and socially distance but these are stressful days and adding a new skill like borrowing e-books from the library might offer you a welcome diversion. I have used the Vancouver Public Library for years and I recommend exploring their website and familiarizing yourself with their e-lending facilities. You can borrow e-books from anywhere in the world with a wifi connection and you can download the VPL app on many different readers including your cell phone, e-reader, iPad, laptop or computer. Typically they give you 21 days to read and return the book but you can return them early. I don’t offer advice about anything other than real estate in this space but these are desperate times and I find comfort in reading and e-books are a great idea so I thought you too might find a benefit in our public library system.

Happy Easter!

Best regards,

Stuart