I hope you and your family are continuing to stay safe and healthy and adjusting to the gradual relaxing of restrictions.

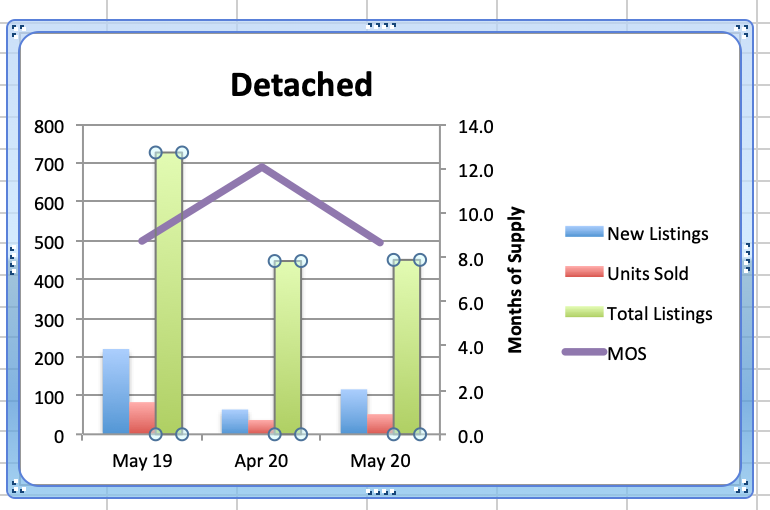

The supply of westside detached homes in May was 450, down slightly from 447 month in April and down 38% compared to 727 last year in May 2019.

Westside detached home sales this May increased 40% from April (52 vs 37) and were 37% lower than May 2019. Detached home sales are down 66% from the 10 year May average of 155 sales.

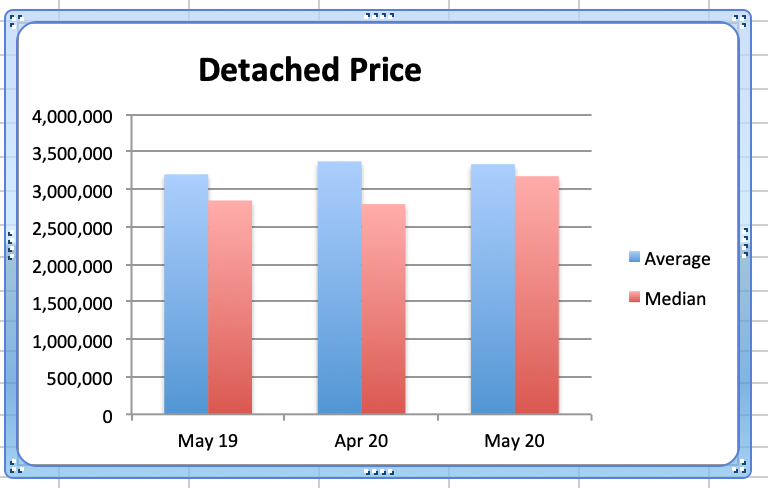

Months of Supply, (MOS) was down 28% from last month to 8.7 from 12.1 and unchanged from May 2019. (A balanced market used to be in the range between 4-7 MOS with prices rising below 4 MOS and falling above 7 MOS but in the last couple of years that seems to have shifted and now appears to be 8 to 10 MOS). The May average price was basically unchanged from April at $3.333M and the median detached home prices increased 13% to $3.174M. Current prices are down 26% on average & 17% on median from the peaks in Oct 2017 and Jul 2017. Detached home sales in May are down 66% from the 10 year average of 155 sales.

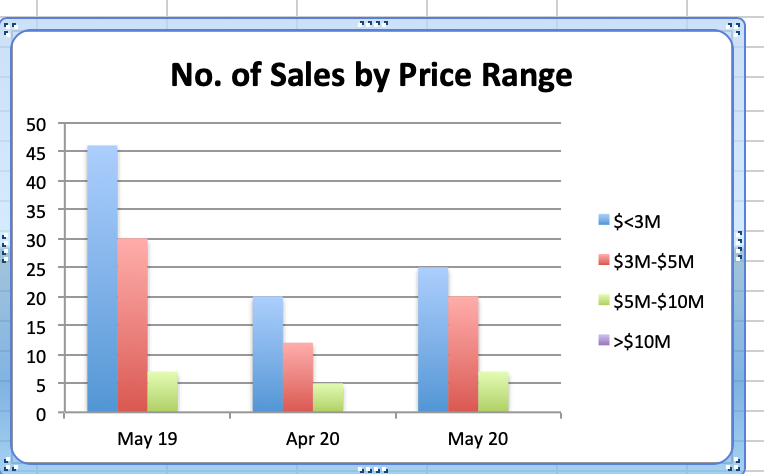

The highest sale price for a Westside detached home in May was $7.4M. It was on the market for 212 days before it sold. The lowest price was $1.48M. It was on the market for 41 days. Of the 52 May sales, 13 received the asking price or more and 39 sold below the asking price.

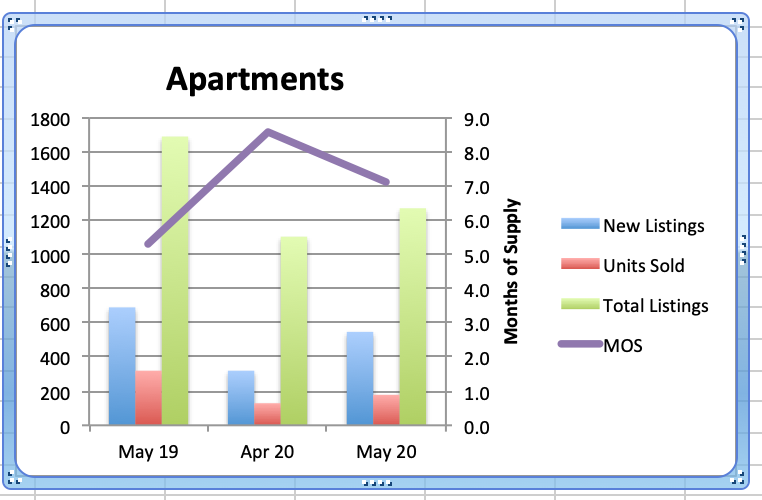

Westside apartment supply increased 15% in May to 1268 vs 1102 in Apr. but this is down 25% from the 1687 listings we had in May 2019. At the same time, demand increased 38% to 178 sales v. 129 sales in April and this is down 44% from 319 sales in May 2019. Apartment sales are down 57% from the 10 year average of 410 sales.

MOS in May decreased to 7.1 from 8.5 in April and is up 35% from 5.3 MOS last May 2019.

The average price increased 5% to $918K in May v. $871K in April and was up 6% from May 2019. The median price was basically unchanged from April ($740 v $745) and is up 3% from last May. Average and median prices are down by 24% & 16% from the peak of $1.199M and $880K in January 2018.

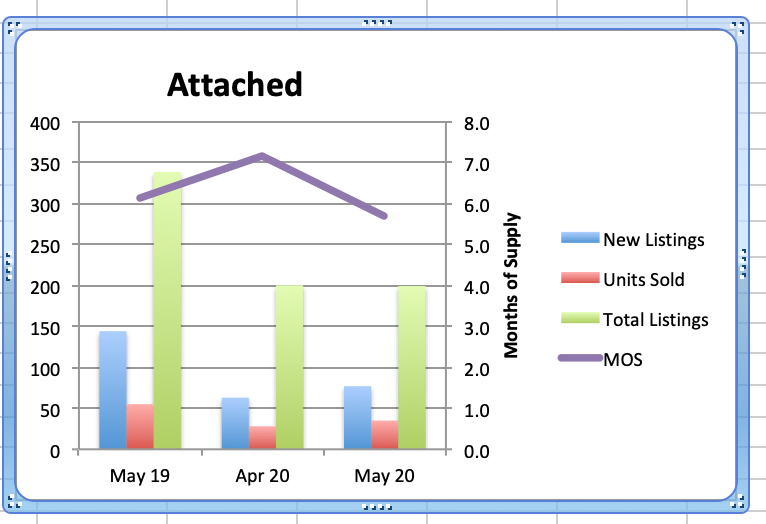

Westside townhouse supply remained unchanged May (199 vs 200) from April and that's down 41% from 338 in May 2019. Demand in May is up 25% to 35 sales from 28 in April and that is down 36% from 55 sales last May 2019. Attached home sales are down 47% from the 10 year average of 66 sales.

With supply unchanged and demand up, current MOS decreased to 5.7 from 7.1 in April. That is down 8% from 6.1 in May 2019.

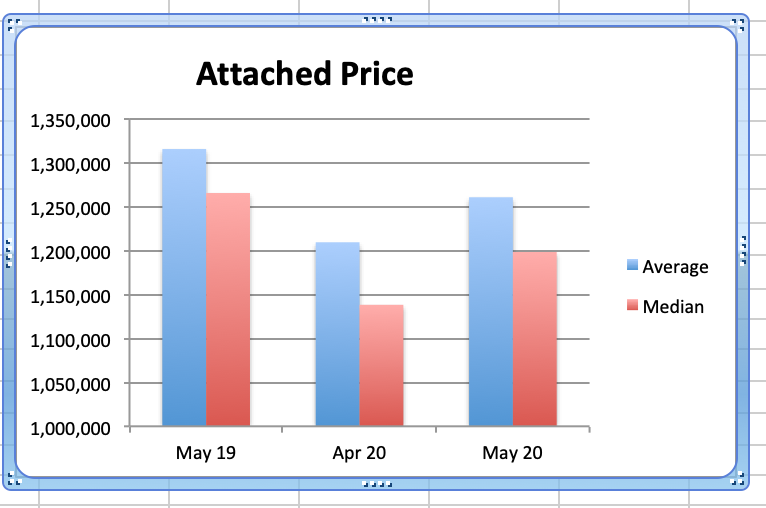

Townhouse average prices in May were up 4% to $1.26M from April and were down 4% from $1.31M last May 2019. Median prices increased 5% to $1.2M from $1.14M in April are down 5% from $1.26M in May 2019. Average prices are down by 30% from the peak of $1.8M in January 2018. Median prices are down 22% from the peak of $1.519M in January 2018.

April stats showed the full negative effect of the Covid pandemic with prices down in apt., attached and detached homes. May has recovered price wise with sales volumes remaining low but increasing over April. May sales volumes are still off from the 10 year average by 66% (det), 57% (apt) and 47% (att) but are an improvement from April. Home prices are up from April but off from the peak, by, on average, 26% for Detached homes, 24% for Apartments and 30% for Attached Homes so all property types still appear to be good value for Buyers.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in the region decreased 43.7% to 1485 this May from 2638 sales in May 2019. This is a 33.9% increase from the 1109 homes sold in April.

May 2020 sales were 54.4% below the 10-year May sales average. (Regional stat)

The total number of properties currently offered on the MLS® system in Metro Vancouver is 9927, down 32.4% from 14685 in May 2019. This is up 5.7%% from last month.

For all property types, the sales-to-active listings ratio for May 2020 is 15%.

Downward pressure on home prices occurs when the ratio dips below the 12% mark for a sustained period, while upward pressure occurs when it surpasses 20% over several months.

Regional numbers are below historical 10 year averages, so westside properties, even further below the the 10 year averages are better relative value. Current supply is down dramatically and that is keeping prices stable even in the face of reduced demand.

Many people are holding off listing their homes thinking this is a bad market price wise but that is not the whole story. Buyers in the market today are often frustrated by the lack of good homes to buy. Time will tell but the short supply and increasing demand will make it harder for buyers and prices may continue to strengthen. Current prices are still well below the peak and are therefore good value.

This is still a Buyers market so if you have been thinking of making a purchase you should do so while the market factors are in your favour.

Happy Father's Day!

Be kind and be careful.

Best regards,

Stuart